Venezuela’s vast natural wealth has once again entered Washington’s strategic calculations. Beyond oil, the country’s potential mineral resources are being framed as assets of national importance, even as experts warn that turning ambition into reality would be far more complex than political rhetoric suggests.

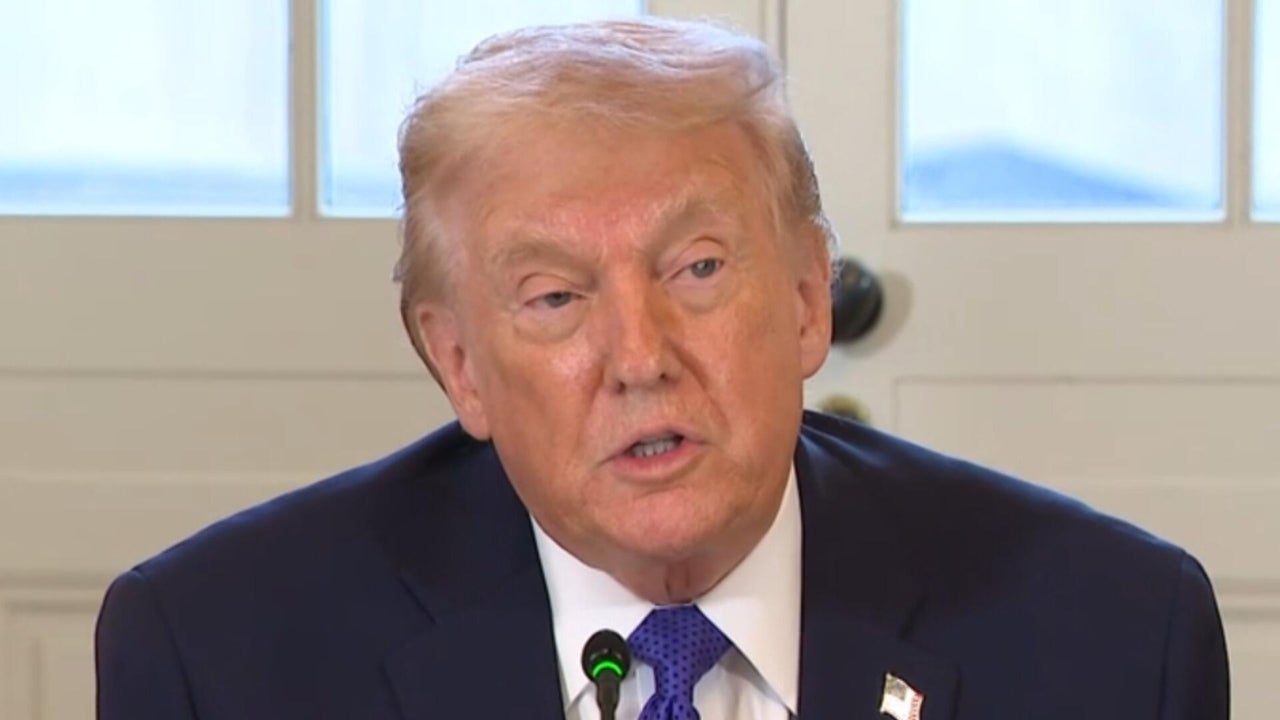

When Donald Trump declared that U.S. companies would gain access to Venezuela’s oil reserves, attention quickly expanded beyond crude. Inside policy circles, the conversation has increasingly included minerals, metals and even rare earth elements believed to exist beneath Venezuelan soil. These materials are essential to industries ranging from defense and aerospace to clean energy and consumer technology, making them a focal point of U.S. national security discussions.

Although drawing on Venezuela’s wider pool of resources might seem appealing in theory, experts warn it carries significant unpredictability. The extent, quality, and economic feasibility of much of this material remain uncertain, and the political, security, and environmental challenges tied to extraction are substantial. Consequently, most specialists concur that even a forceful effort from Washington would be unlikely to provide meaningful relief to America’s overburdened supply chains in the short or medium term.

Strategic interest beyond oil

For decades, Venezuela has been closely associated with oil, its vast proven crude reserves ranking among the world’s largest and influencing both its economic trajectory and its complex ties with the United States. Yet shifting geopolitical dynamics have broadened the notion of “strategic resources” well beyond hydrocarbons, as critical minerals and rare earth elements have become essential components for advanced manufacturing, renewable energy technologies and modern military equipment.

Officials within the administration have indicated they understand Venezuela’s worth could reach further than petroleum, and Reed Blakemore of the Atlantic Council Global Energy Center notes that many now recognize the nation may possess a broader spectrum of natural resources. Yet he and others stress that recognizing such potential does not automatically translate into the capacity to harness it.

The difficulties linked to mining and exporting minerals in Venezuela are, in many ways, even more formidable than those confronting the oil industry, since oil extraction benefits from existing infrastructure and well-established global markets, whereas developing the mineral sector would demand broad geological assessments, substantial financial commitments and enduring stability — requirements that Venezuela does not currently meet.

Uncertainty beneath the surface

One of the central problems facing any attempt to develop Venezuela’s mineral resources is the absence of reliable data. Years of political upheaval, economic crisis and international isolation have left large gaps in geological information. Unlike countries with transparent reporting and active exploration programs, Venezuela’s subsurface wealth is poorly mapped and often discussed in speculative terms.

The United States Geological Survey does not include Venezuela among the nations with verified rare earth element reserves, a gap that does not confirm their absence but rather highlights the limited extent of validated data. Specialists suggest that Venezuela could contain deposits of minerals like coltan, which provides tantalum and niobium, along with bauxite, a source of aluminum and gallium. U.S. authorities classify all these metals as critical minerals.

Past Venezuelan leaders have made bold claims about these resources. In 2009, former president Hugo Chávez spoke publicly about large coltan discoveries, portraying them as a national treasure. Later, under Nicolás Maduro, the government established the Orinoco Mining Arc, a vast region designated for mineral exploration and extraction. In practice, however, the project became synonymous with environmental degradation, illegal mining and the presence of armed groups.

Security, governance and environmental risks

Mining is by nature a highly disruptive pursuit that depends on consistent governance, clear and enforceable rules, and assurances of long-term security. In Venezuela, such foundations are largely missing. Many areas thought to hold significant mineral reserves are isolated and poorly administered, leaving them exposed to unlawful activities.

Armed groups and criminal networks remain firmly embedded in illegal gold extraction in several regions of the country, as noted in numerous independent reports. With minimal oversight, these actors fuel violence, widespread deforestation and severe environmental contamination. Bringing in legitimate, large-scale mining operations under such conditions would be extremely challenging without sustained improvements in security and the enforcement of the rule of law.

Rare earth mining presents additional challenges. Extracting and processing these elements is energy-intensive and can generate hazardous waste if not properly managed. In countries with strict environmental standards, these risks translate into higher costs and longer project timelines. In Venezuela, where regulatory enforcement is weak, the environmental consequences could be severe, further complicating any attempt to attract responsible international investors.

As Blakemore has observed, even with favorable expectations, transporting Venezuelan minerals to international markets would prove a far tougher undertaking than developing oil. In the absence of reliable assurances on security, environmental safeguards, and consistent policies, only a handful of companies would consider investing the massive sums such initiatives demand.

China’s commanding role in processing and refining

Even if U.S. firms managed to clear the obstacles involved in extraction, they would still face another looming bottleneck: processing. Obtaining raw materials represents only the initial phase of the supply chain, and when it comes to rare earths, the refinement and separation stages are both the most technologically demanding and the most capital‑intensive.

Here, China maintains a powerful lead. The International Energy Agency reported that, in 2024, China was responsible for over 90% of the world’s refined rare earth output. This overwhelming position stems from decades of government backing, assertive industrial strategies and relatively relaxed environmental oversight.

As Joel Dodge from the Vanderbilt Policy Accelerator has noted, China’s dominant position in processing grants it significant industrial and geopolitical influence, and although rare earths may be extracted in other regions, they are frequently routed to China for refinement, which further consolidates Beijing’s pivotal place within the supply chain.

This reality complicates Washington’s strategic calculations. Securing access to raw materials in Venezuela would do little to reduce dependence on China unless parallel investments were made in domestic or allied refining capacity. Such investments would take years to materialize and face their own regulatory and environmental hurdles.

Strategic importance of critical minerals for national security

The United States currently designates 60 minerals as “critical” due to their importance for economic and national security. This list includes metals such as aluminum, cobalt, copper, lead and nickel, as well as 15 rare earth elements like neodymium, dysprosium and samarium. These materials are embedded in everyday technologies, from smartphones and batteries to wind turbines and electric vehicles, and are also essential for advanced weapons systems.

Although their name suggests otherwise, rare earth elements are actually relatively plentiful within the Earth’s crust. As geographer Julie Klinger has noted, the real challenge stems not from limited supply but from the intricate processes required to extract and process them in ways that are both economically feasible and environmentally responsible. This nuance is frequently overlooked in political debates, resulting in overstated assumptions about the strategic importance of undeveloped deposits.

U.S. lawmakers have grown increasingly troubled by the nation’s dependence on overseas suppliers for these materials, especially as tensions with China escalate, and efforts have emerged to bolster mining and processing within the country. Yet these domestic initiatives encounter extended timelines, local resistance and rigorous environmental assessments, so rapid outcomes remain improbable.

Venezuela’s constrained influence in the coming years

Against this backdrop, expectations that Venezuela could emerge as a significant supplier of critical minerals appear unrealistic. Analysts at BloombergNEF and other research institutions point to a combination of factors that severely constrain the country’s prospects: outdated or nonexistent geological data, a shortage of skilled labor, entrenched organized crime, chronic underinvestment and an unpredictable policy environment.

Sung Choi of BloombergNEF has argued that, despite Venezuela’s theoretical geological potential, it is unlikely to play a meaningful role in global critical mineral markets for at least the next decade. This assessment reflects not only the technical challenges of mining, but also the broader institutional weaknesses that deter long-term investment.

For the United States, this means that ambitions to diversify supply chains cannot rely on Venezuela as a quick fix. Even if diplomatic relations were to improve and sanctions eased, the structural barriers would remain formidable.

Geopolitics versus economic reality

The renewed focus on Venezuela’s resources illustrates a recurring tension in global economic policy: the gap between geopolitical aspiration and economic feasibility. From a strategic perspective, the idea of accessing untapped minerals in the Western Hemisphere is appealing. It aligns with efforts to reduce dependence on rival powers and to secure inputs vital for future industries.

However, the development of natural resources is shaped by unavoidable practical constraints, as mining endeavors depend on dependable institutions, clear regulatory frameworks and long-term commitments from both governments and companies, while also relying on local community acceptance and credible, robust environmental protections.

In Venezuela’s case, decades of political turmoil have eroded these foundations. Rebuilding them would require sustained reforms that extend far beyond the scope of any single trade or energy initiative.

A sober assessment of expectations

Experts ultimately advise approaching political claims about Venezuela’s resources with care, noting that although the nation’s subterranean riches are frequently depicted as immense and potentially game‑changing, available evidence points to a much narrower reality, with oil standing as Venezuela’s most clearly identifiable asset, yet even that sector continues to encounter substantial production hurdles.

Minerals and rare earth elements add another layer of complexity, with uncertain quantities, high extraction costs and global supply chains dominated by established players. For the United States, securing these materials will likely depend more on diversified sourcing, recycling, technological innovation and domestic capacity building than on opening new frontiers in politically unstable regions.

As the worldwide competition for critical minerals accelerates, Venezuela will keep appearing in strategic debates, yet its influence will probably stay limited without substantial on-the-ground reforms; aspiration by itself cannot replace the data, stability, and infrastructure that form the core of any effective resource strategy.